This Week's Web3 Reads: Strategic Liquidity Provision on L2s, pm-AMM as a Better AMM for Prediction Markets

Web3 Reads is our weekly round up of the top educational, research, and mechanism insights from the industry, along with quick easy to digest summaries.

Mechanism ⚙️

Strategic Liquidity Provision on L2 by Alex Nezlobin (@0x94305)

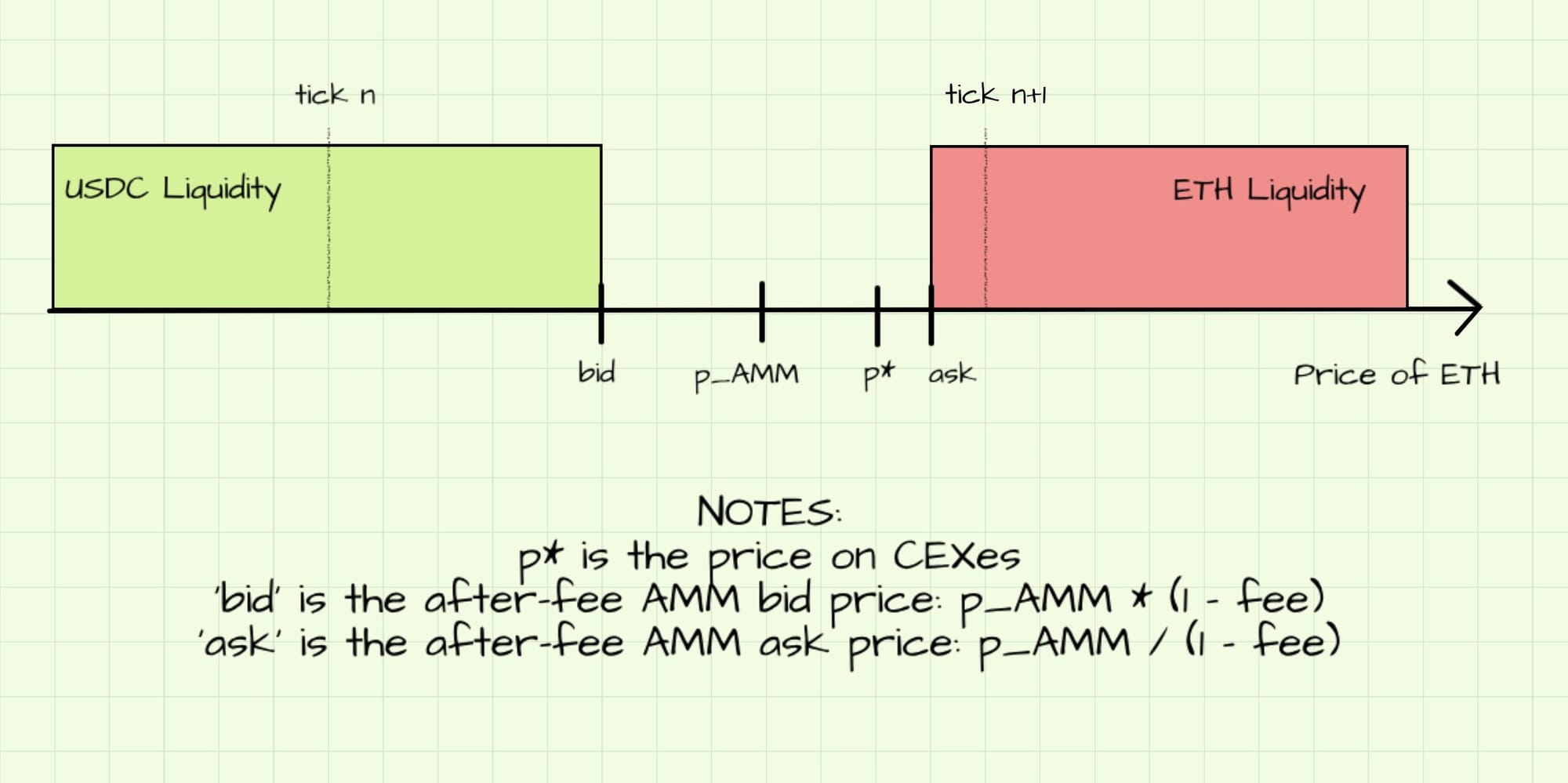

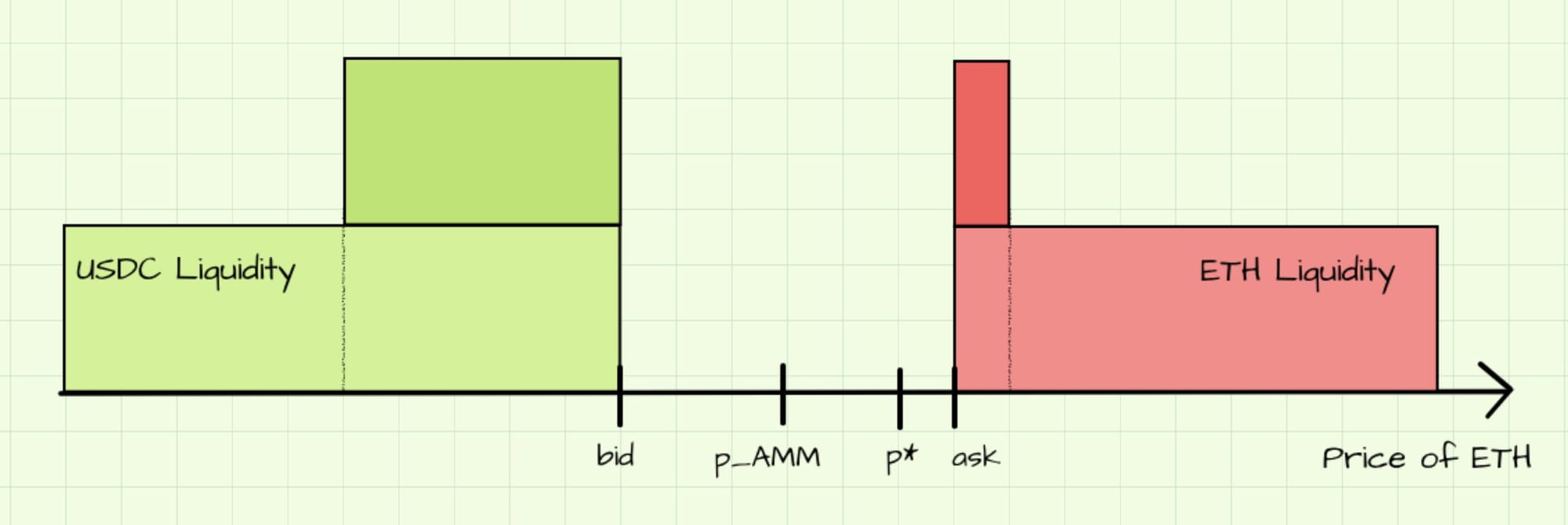

Just-in-time (JIT) liquidity on the mainnet is well known, but Layer 2 (L2) networks present unique opportunities for active liquidity providers (LPs). In certain conditions, a pool may exhibit the following characteristics:

- The centralized exchange (CEX) price, represented as p∗p^*p∗, is close to the pool's after-fee ask price.

- The after-fee upper tick is also near the ask price.

- The lower tick, however, is significantly distant from the pool's bid price.

This configuration opens up specific strategic possibilities for LPs.

One strategy is to add liquidity within the active range. If p∗p^*p∗ crosses the ask price, LPs are exposed to some arbitrage flow, but the proximity of the upper tick to the ask price keeps Loss vs. Rebalancing (LVR) risks minimal. This position also enables LPs to capture profitable uninformed flow on the bid side.

If p∗p^*p∗ crosses the bid price, bid-side exposure becomes risky. However, on fast L2s, LPs can often remove liquidity in time to avoid losses from arbitrage trades.

L2s, with low-cost operations and fast blocks, allow LPs to flexibly add or remove liquidity based on the CEX price within the AMM spread, similar to market makers on order book platforms. While it’s unclear if this exact strategy is widely used, bots on Arbitrum and Base show signs of similar tactics.

Questions remain about its effectiveness and adaptability to various L2 ordering models. These active LP strategies improve liquidity and execution quality for uninformed flow but increase competition, which may reduce passive liquidity.

Read more in the original tweet thread from Alex Nezlobin.

Want to Reach Developers?

Web3 Builder news is read by an avid audience of developers and builders. If you want to reach this influential audience, contact us.

pm-AMM: A Uniform AMM for Prediction Markets by Paradigm

The pm-AMM is a new automated market maker (AMM) designed specifically for prediction markets, which currently rely heavily on order books rather than AMMs. Traditional AMMs struggle with outcome tokens, which are highly volatile and time-dependent, leading to inconsistent liquidity and losses for liquidity providers (LPs) when markets close.

This research introduces a Gaussian score dynamics model for outcome tokens in prediction markets and develops a new AMM structure—pm-AMM—that better aligns with these dynamics. The pm-AMM’s design leverages loss-vs-rebalancing (LVR) to control LP losses from arbitrage.

Static and Dynamic pm-AMM

The static pm-AMM provides consistent LVR across price ranges but sees increasing LVR near market expiration, due to rising volatility. The dynamic pm-AMM addresses this by reducing liquidity over time, keeping LVR steady until expiration. This approach helps LPs manage risk while maintaining stable liquidity.

Prediction Markets and Gaussian Score Dynamics

Prediction markets involve bets on outcomes like election results or asset prices. The Gaussian score dynamics model assumes a predictable flow of information, making it suitable for events with consistent updates (e.g., sports scores) but not for rare events (e.g., natural disasters). This model aids in creating AMMs that match the volatility of outcome tokens.

Loss-vs-Rebalancing and Uniform AMMs

LVR quantifies the losses LPs face from arbitrage. A uniform AMM maintains a consistent rate of LVR, independent of asset price. The pm-AMM’s uniform structure concentrates liquidity near the center price (50% probability) and reduces it at extreme prices, minimizing volatility-driven losses.

The pm-AMM represents a significant step forward in the development of AMMs specifically designed for prediction markets. Read more in the original paper.

Insights 👁️

Ethereum's Distinctive Property is Hardness by Josh Stark (@0xstark)

Ethereum provides a unique form of "hardness," which allows individuals to create a predictable and reliable future. By encoding data and logic into Ethereum, users receive strong guarantees of permanence, enabling coordination for essential structures like money, contracts, and governance in a digital economy. This "hardness" supports large-scale collaboration and ensures a stable foundation for future interactions.

Beyond blockchains, traditional institutions and physical matter also provide hardness, seen in the permanence of laws, property rights, and finite resources like gold. These three sources—institutions, atoms, and now blockchains—offer fixed points that allow us to create systems of order and value.

Ethereum's hardness is distinctive. It is decentralized, accessible globally, and designed to remain resilient regardless of institutional or political shifts. Unlike centralized platforms, Ethereum does not rely on any single authority, offering transparency and self-verifiability that grows with technological advances. This resilience ensures that Ethereum's promises remain intact, independent of external influences.

Ethereum will not replace traditional institutions but will complement and sometimes compete with them. This creates a new market for hardness, allowing individuals to choose between Ethereum’s predictable digital structure and institution-driven systems where discretion is needed. Just as architects choose materials carefully, society must consider the building blocks of its future infrastructure. Ethereum’s hardness poses the question of what materials we wish our civilization to be built upon.

dApps Graveyard by w1nt3r.eth (@w1nt3r_eth)

Despite blockchain’s permanence, many dApps from recent years are no longer accessible, revealing a gap between the decentralized ideal and the reality. Most dApps rely on centralized services (e.g., hosting, domains) that undermine their resilience and independence.

The Vision vs. Reality

Originally, dApps were meant to operate independently on decentralized infrastructure like IPFS. However, achieving a competitive user experience (UX) has proven difficult, as decentralized solutions often lack the speed, ease of use, and accessibility of web2 apps. This UX shortfall deters many users from fully adopting dApps.

Developer Trade-Offs

Web3 developers face a tough choice: create fully decentralized apps with limited usability or use centralized solutions for a better UX. While some opt for a hybrid approach, adding centralized features to improve UX, these solutions do not simplify development or fully uphold decentralization ideals.

Infrastructure Challenges

For dApps to truly flourish, decentralized infrastructure needs major improvements, such as IPFS browser support, decentralized databases, and alternatives to centralized backends. Achieving this requires new technological breakthroughs and incentive models that currently don’t exist.

Current Compromise

Today, the market has settled into a hybrid model: blockchains provide a decentralized foundation, while centralized applications offer superior UX. Although this contradicts the original vision, it enables mainstream usability. For now, the dApp ideal is on hold as the ecosystem continues to evolve, with decentralization remaining largely at the infrastructure level.

Source: Dapps Graveyard by w1nt3r.eth

Like this content? Subscribe to stay up to date.