This Week's Web3 Reads: Vitalik Shares Ethereum Roadmap, AI Agents Being Launched With Pump.fun Model

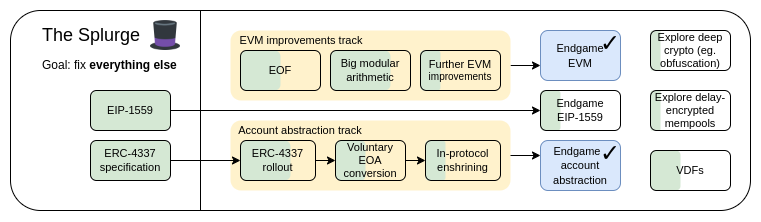

Ethereum’s Future: The Splurge by Vitalik Buterin

Ethereum's 2024 roadmap includes "The Splurge," a series of enhancements that don’t fit into existing categories but are crucial to Ethereum's long-term performance, security, and scalability. Here’s what’s in focus:

EVM Enhancements

EOF (EVM Object Format) improves efficiency by allowing dynamic jumps, gas-oblivious code, and better modular arithmetic. This upgrade sets up the EVM for advanced cryptographic functions and higher performance. It also benefits new contract styles with potential for further cost optimizations.

EVM-MAX and SIMD enable cryptography-heavy operations, such as elliptic curve cryptography, by allowing optimized, parallel processing.

Account Abstraction (AA)

Expands beyond ECDSA signatures for flexibility and enhanced security. EIP-4337 introduces phased validation, reducing DoS risks and gas costs. Features like Paymasters (accounts paying fees for others) and Aggregators (efficient signatures) aim to streamline transaction costs and enable better user experience.

EIP-1559 Upgrades

Refines fee algorithms for optimal block inclusion, introducing multidimensional gas to account for different resource costs (like calldata, state access). This improves efficiency, especially in high-demand scenarios.

Verifiable Delay Functions (VDFs)

Targets more secure randomness in proposer selection, reducing potential manipulation. However, it’s a complex implementation with hardware risks, aiming for improved randomization in on-chain applications and encrypted mempools.

Future Cryptography

ZK-SNARKs, Fully Homomorphic Encryption (FHE), and Indistinguishability Obfuscation (iO) bring significant potential. These advanced cryptographic protocols offer scalability, privacy, and decentralized trust. While FHE and iO are still emerging, they could transform Ethereum applications, making them more resilient, efficient, and scalable.

Virtuals Protocol: Launching AI Agents with the Pump.fun Model by Shoal Research

Virtuals Protocol brings "memecoin" launch tactics to AI agents, allowing community-driven tokenization and AI functionality on the Base layer 2 chain. Through Initial Agent Offerings (IAOs), users gain token-based ownership and governance over agents, paired with Virtuals' $VIRTUAL token. Revenue mechanisms, including buybacks and burns, aim to boost agent value based on community engagement.

Key tech features like Parallel Hypersynchronicity allow agents to function seamlessly across applications. Virtuals' tokenomics model leverages transaction fees to maintain the ecosystem, while developer tools such as G.A.M.E and MarioVGG enable dynamic, AI-driven content creation and user interaction.

Despite its innovative model, Virtuals faces the challenge of balancing engagement with speculative demand. The project’s reliance on attention-driven economics could impact token stability as it scales, with long-term success hinging on sustained developer and user interest.

Futarchy as Trustless Joint Ownership by Kevin Heavey

Futarchy, a governance model using predictive markets, offers a solution for "trustless joint ownership," enforcing shared ownership in DAOs without needing legal systems or majority-holder goodwill.

Traditional companies protect minority shareholders with legal frameworks, but DAOs using token-based voting often lack enforceable protections, exposing minority holders to potential exploitation. Token-voting DAOs have seen cases of misappropriation and ineffective proposals due to this vulnerability.

Futarchy allows for market-based decisions by creating conditional markets ("pass" or "fail" tokens) on proposals. This setup incentivizes holders to prioritize long-term value, making it financially unappealing for majority holders to push self-serving proposals.

Futarchy has already shown success in protecting DAOs, as seen in MetaDAO. While it can’t prevent all forms of mismanagement, futarchy is a promising standard, enabling fair, decentralized governance. As futarchy gains traction, DAOs sticking with token-voting governance may increasingly be seen as outdated and less secure.

Trader's $26M Trump Bet Exposes Polymarket’s Prediction Flaw by DeFiLlama

A $26 million bet on Polymarket in favor of Trump, placed by a French trader, has skewed the odds heavily in his favor, even though polls slightly favor Kamala Harris. This single wager highlights Polymarket's vulnerability to major bets and its limited liquidity.

Liquidity Issues and Manipulation Concerns

Polymarket’s thin liquidity makes it susceptible to large trades that can distort predictions. Experts argue this limits the platform’s forecasting accuracy, as significant bets from single players can easily sway market odds.

Market Sentiment vs. Predictive Reliability

Polymarket aims to capture "wisdom of the crowd" in its predictions, but experts like Harry Crane suggest it struggles with reliability when big players dominate, leading to irrational market movements.

Prediction Markets’ Future Potential

Despite current issues, some analysts see a role for prediction markets in election forecasting. They argue, however, that improved liquidity and structure are essential for these platforms to be taken seriously in the future.

Superchain's Role in Shaping Layer 2 with Swell and Unichain by Four Pillars

With nearly 200 rollups on Ethereum, half already on mainnet, only rollups with clear value and transaction volume are likely to succeed. Superchain, a network of OP Stack-based rollups, is working to unify this ecosystem, focusing on unique offerings and collaboration.

Swell L2, Unichain, and Kraken's Ink bring distinct roles. Swell L2 focuses on "Swell Assets" using Proof of Restaking (PoR) with EigenDA and AltLayer infrastructure, while Unichain, developed by Uniswap Labs, leverages Flashbots’ Rollup-Boost for quick block times and enhanced liquidity. Kraken’s Ink connects centralized exchanges (CEXs) to DeFi, creating a bridge for new users.

By aligning technology, economics, and governance, Superchain aims to build a cohesive and efficient ecosystem. Each rollup is encouraged to specialize—Swell for restaking, Unichain for liquidity, and Ink for bridging CEX users to DeFi—helping avoid overlap. Learning from Cosmos Hub's experience, Superchain’s focus on differentiation and innovation is key to sustainable growth and leadership.

Like this content? Subscribe to stay up to date.